Like many other sectors, banks and insurance companies have been hit hard by the Covid-19 crisis, lockdown and health measures taken by the government. Today, these companies are faced with new challenges, including digital transformation. Although this digital transformation has been underway for several years, the crisis has accelerated it. This article takes a look...

Like many other sectors, banks and insurance companies have been hit hard by the Covid-19 crisis, lockdown and health measures taken by the government.

Today, these companies are faced with new challenges, including digital transformation. Although this digital transformation has been underway for several years, the crisis has accelerated it.

This article takes a look at the two main aspects of this digital transformation – improving the customer journey and enriching customer knowledge.

The Covid-19 Crisis is not at the Origin of Digital Transformation, but an Accelerator

The Covid-19 health crisis has impacted all areas of the economy, some more severely than others, and continues to weigh heavily on business activity.

To understand the impact of the Covid-19 crisis on the customer experience, read this recent KPMG study

The banking and insurance sectors are no exception. The health crisis, along with the measures taken to manage it, have increased the role of digital channels in the customer journey – websites, mobile apps, social media… During lockdown, physical touchpoints were temporarily replaced by digital ones.

This shift from the physical to the digital has brought digital transformation back to the forefront. This is nothing new for banks and insurance companies. The digitalisation of access to banking and insurance services, as well as the digitalisation of the customer relationship, has been underway for several years now.

Banks and insurance companies are all moving in the same direction, at different speeds, driven by a twofold requirement:

- To adapt to new customer expectations and demands. Customers have become omnichannel – they use both offline and online channels, constantly switching from one to the other. They also expect an omnichannel customer experience, i.e. a seamless and consistent customer experience across all physical and digital channels.

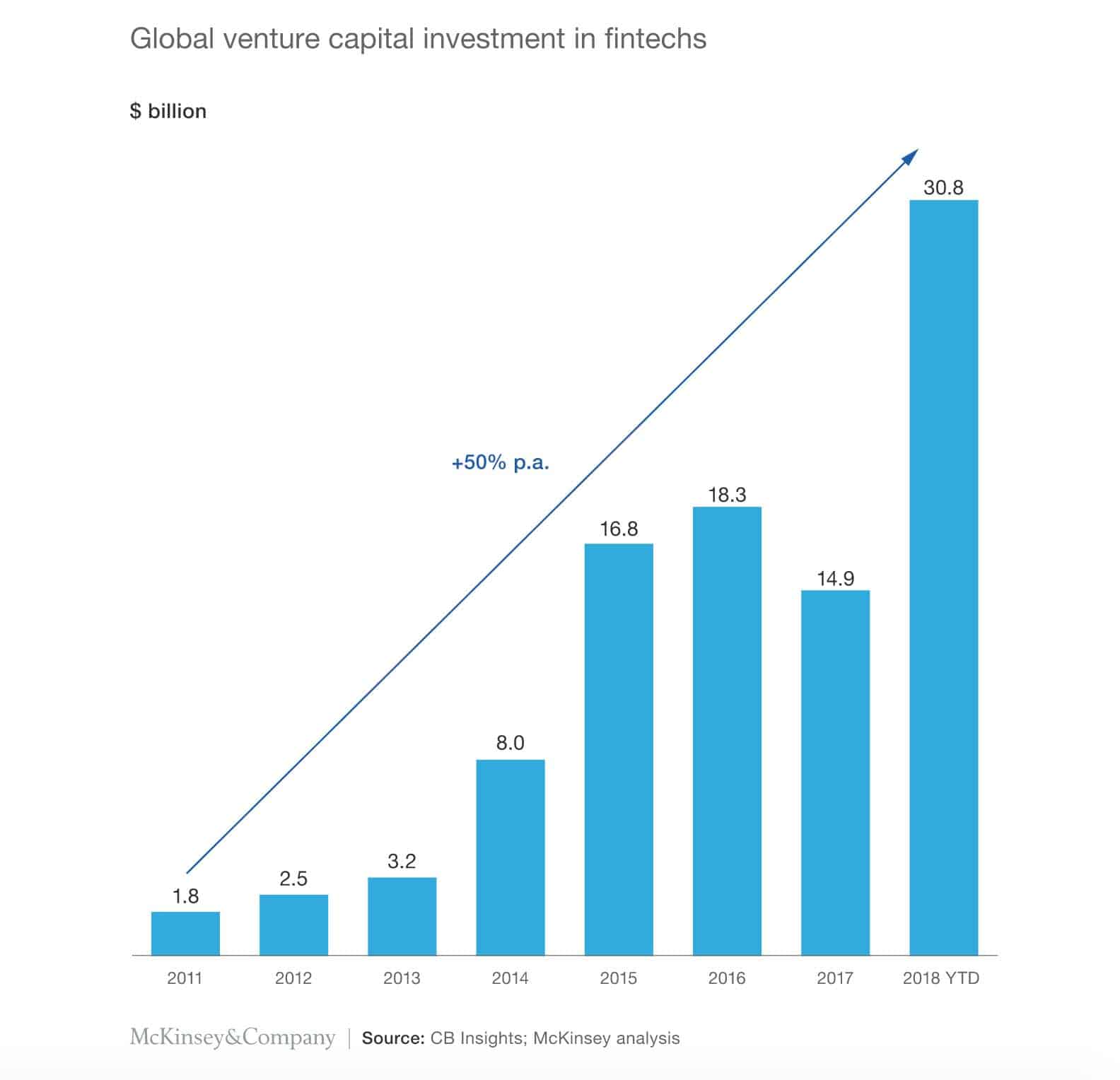

- To adapt to the competition, which is particularly fierce in the banking and insurance sectors, particularly following the rise of FinTech, online banking and InsurTech companies, that are reshaping the market and putting more traditional players at risk.

The digital transformation of the banking and insurance industry is not a result of the current crisis and should not be reduced to a crisis management strategy. Digital transformation is not a result of circumstances, it is a structural and forward-thinking project. It is the response to a risk as much as the means to an ambition. This is a necessary change, which was already under way before the unprecedented Covid-19 crisis.

Credit: McKinsey

Improving the Customer Journey and Customer Knowledge Through Digital Transformation

What is digital transformation for banks or insurance companies? What exactly does it involve?

The term ‘digital transformation’ is often thrown around without being defined in practical terms. Digital transformation is multiform. It impacts all aspects of an organisation:

- The “back office”, i.e. all the processes and procedures relating to the admin and support teams. Digital transformation allows to gain in efficiency, productivity and performance.

- The “front office”, i.e. all the touchpoints between a company and customers – the customer relationship, in the broadest sense.

This article will focus on the second aspect. We believe that digital transformation has a major role to play in the banking and insurance industry to improve the customer journey and develop customer knowledge.

Developing the Customer Journey and Enriching/Harmonising the Customer Experience

We already touched on this point at the beginning of the article. Banks and insurance companies have been committed to incorporating digital channels into the customer journey for several years now. All banks and insurance companies have a website, mobile app and a social media presence. The industry has had to adapt in order to meet a strong customer expectation. Digitalising the customer journey means adopting new tools for managing digital touchpoints and putting in place the right processes.

There are always aspects of the digital journey that can be improved, in particular those that impact customer performance the most. Take for example the insurance sector:

- The sign-up journey, which should be as smooth and reassuring as possible for future customers.

- The claims management journey, which often generates friction and customer dissatisfaction.

3 areas to improve in the customer journey

The two examples above show that improving the customer journey impacts both customer acquisition and retention. In the banking and insurance industry, we have identified the three following areas for improvement:

- Simplification. The main value proposition of FinTech and InsurTech pure play companies can be summed up in two key words: simplicity and instantaneity. In order to compete with these newcomers, traditional players must simplify their procedures and journeys to make their services more easily accessible. Digitalisation, and particularly the “mobile first” approach, meets this challenge.

- Reassurance. It is unfortunate, but the truth is that customers often mistrust banks and insurance companies, and even dislike them. They therefore need to be reassured at every touchpoint, whether physical or digital – website, emails, during exchanges with an agent, etc.

- The optimisation of the customer experience during moments of truth. The work required here is twofold. Firstly, identifying these moments of truth. Secondly, identifying priority areas for improvement.

A study conducted by Xerfi revealed that the main reason customers change banks is a bad experience, ahead of bank fees. This shows just how important it is to optimise the customer experience, which involves working on and making changes to the journey.

Enriching Customer Knowledge with Data

Digital technologies provide a great deal of data. Digital channels facilitate the collection of customer information. In our opinion, one of the most important parts of digital transformation is the improvement of customer knowledge.

Discover our article Banking & Insurance Sector – How to set up a customer satisfaction dashboard

Why?

Customer knowledge enables you to enrich the customer relationship, to personalise your products and services, as well as customer interactions. Personalisation is key to nurturing a quality customer relationship, developing customer loyalty, and managing attrition risk. This is an important point, particularly when bearing in mind that the attrition rate doubled between 2013 and 2018 in the banking sector (Source: Bain & Company). Remember that in the banking and insurance sectors, the products sold are intangible. They are based on contracts. In this case, even more so than elsewhere, the customer relationship is key. The customer relationship should be as rich and well-cared for as the relationship with a policy or account holder.

How?

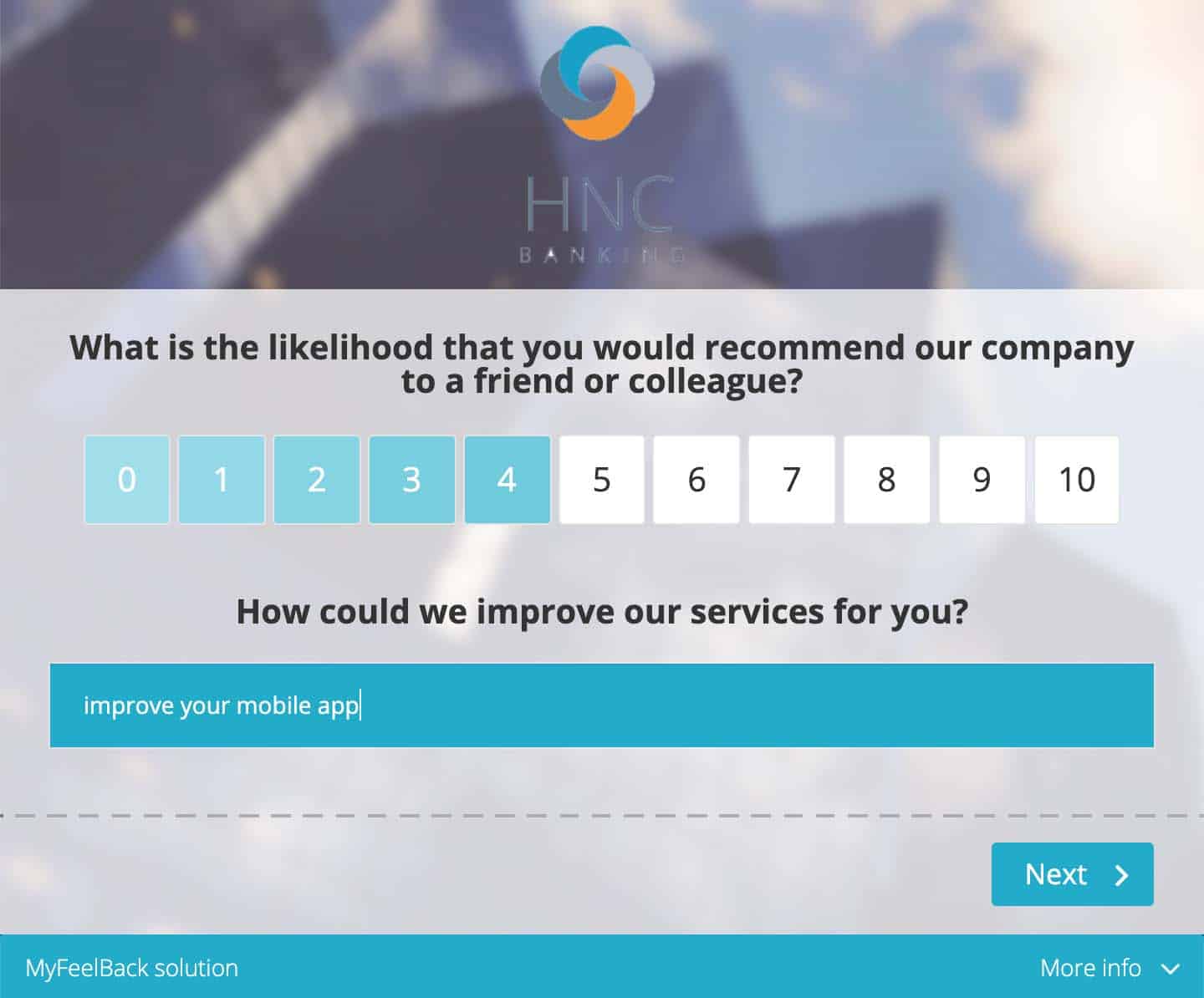

There are several tools available for banks and insurance companies. Satisfaction surveys are one of the most efficient here.

Thanks to technological advances, surveys can be deployed on all channels, at the right time, particularly following a customer interaction. Customer knowledge solutions, such as MyFeelBack, make it easier to analyse and activate answers. Satisfaction surveys, sent in the immediate aftermath, are the best tools for identifying the areas for improvement on your customer journeys. Customer knowledge involves listening to the Voice of the Customer.

Among all sectors of the economy, the banking and insurance sectors are marked by strong competition and, in general, a fairly weak affinity with customers. Customer retention is a key challenge, that involves monitoring customer satisfaction and improving the customer journey (particularly digital ones). These two areas are key to the digital transformation process that banks and insurance companies must continue to pursue.